Stock market performance is impacted by economic factors, such as consumer spending, inflation, and GDP. For example when consumer spending declines for some reason like when gasoline prices rise or media fear mongering succeeds, it leads to a slowing economy. When economies are slow, companies tend to cut back on expenses, this sometimes means layoffs, higher unemployment and even less consumer spending. This creates a vicious cycle which leads to lower company profits, lower levels of investment in the market, which causes stock prices to fall.

The heights and lows of the stock market are generally cyclical yet unpredictable. However, over the longer term there tends to be general growth on all major stock market indices. At Excellence Canada, we have always been interested in knowing if a focus on Excellence helps out with making the unpredictable nature of the stock market a little more predictable.

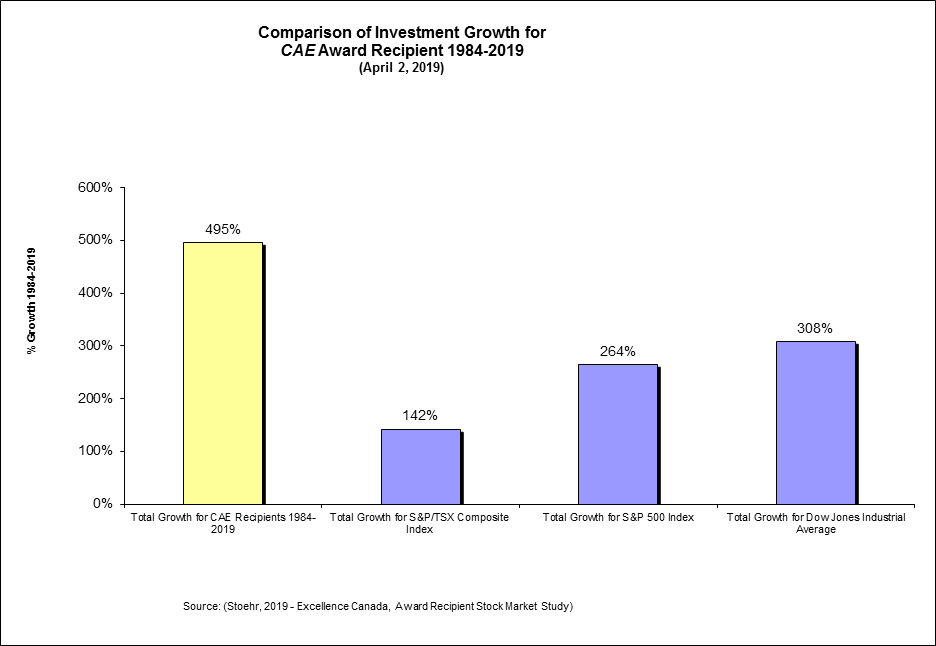

To see if there is any link between a commitment to Excellence and stock price, Excellence Canada tracks the stock performance for all of the Canada Awards for Excellence (CAE) recipients who are traded on a stock market. Once again in 2019, if you look at the collective return for all of the recipients between 1984 and 2019 the CAE recipients have come out on top again. Including the 2018 recipients, the organizations that have won CAE Awards outperform popular composite indices by as much as 2.46:1.

For the purposes of this research, starting with the 1984 CAE Award recipients that are traded on a stock exchange, the researcher bought an imaginary $1,000 worth of the stock on the day the winners were announced. On that same day the researcher invested an imaginary $1,000 in three popular Stock Market Indices (TSX Composite Index, S&P 500, DJIA). Each year (from 1984-2019) the researcher uses the same investment method. The following chart shows the comparison of growth.

This comparison includes all 90 CAE Award recipients that are traded on a stock exchange between 1984 and 2019. The three biggest winners in terms of investment growth include Texas Instruments (CAE Recipient 1992), IBM (CAE Recipient 1984, 1993, 1990), and John Deere (CAE Recipient 1998). The three biggest losers in terms of investment losses include Nortel (CAE Recipient 1990), Dana (CAE Recipient 2001), and Chrysler (CAE Recipient 1991).

In total the researcher invested an imaginary $90,000 ($1000 for each recipient) in stock of award recipient and $90,000 in a composite index. Today (April 3, 2019) the CAE stock investment would be worth $535,900 (growth of 495%) where the S&P/TSX Index investment for example would be worth $218,006 (growth of 142%).

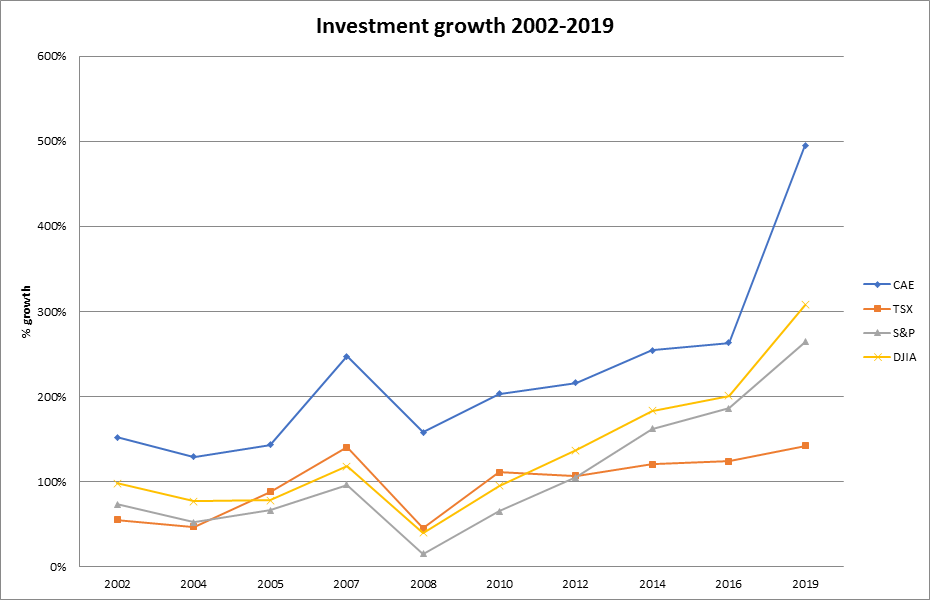

Since 2002 when this research commenced, CAE recipients have consistently outperformed the market. On the chart below the blue line represents the investment growth for the Canada Award for Excellence recipients and the other lines represent the investment growth of the indices. The peaks like in 2007, 2016 and 2019 are higher than the peaks of the indices. The valleys like in 2004, 2008, and 2010 are also higher for the CAE index. A commitment to Excellence makes the unpredictable market a little more predictable with higher levels of growth in every single year the research has been conducted.

Overall this research shows that organizations with a commitment to Excellence collectively have better stock market performance than any of the popular indices. The value of the investment in CAE recipients in 2019 is 2.46 times greater than the value of the investment in the S&P/TSX composite index.