A Standard to support your employees’

financial well-being

Financial Wellness

Successful organizations know that a conscious effort to focus on employee wellness will have a direct impact on the success of the contributions made by employees, and to the overall success of the business outcomes.

Request a complimentary 30-minute consultation and receive a copy of the Financial Wellness Standard

Your Employees’ Financial Well-being Matters

Financial wellness is one of the core elements required for the overall well-being and the total health of an individual.

Employers that focus on the overall health of their people recognize the need for policies and corporate values that support employee health, including physical, psychological and financial wellness. It is good business to have employees who are physically and psychologically healthy and safe, and managers who are sensitive to the impact of short- and long-term decisions on employee health.

Three Elements of Financial Wellness

Combining the 3 elements of financial wellness at a high level means an employee has the money to meet

short-term obligations, is making appropriate plans to meet long-term obligations, and the knowledge,

skills, and confidence to manage their financial affairs.

Financial Health

An objective measure relating to an employee’s financial resources and the ability to meet their ongoing financial obligations including planning for retirement. Financial health may change over time depending on the employee’s life stages and commitments.

Financial Well-being

A subjective measure, involving an employees’ attitudes and confidence about their financial situation, and about their ability to manage it over the short- and long-term.

Financial Literacy

The knowledge, the skills and the confidence needed to make responsible financial decisions, along with the ability to apply that knowledge to everyday life. Financial literacy is necessary for financial well-being and wellness, although not sufficient on its own.

The Case for Financial

Wellness

Money is one of the most frequently reported causes of stress. Stress is one of the most influential determinants of health. According to the 2016 Sun Life Canadian Health Index Survey,

%

of individuals were experiencing uncomfortable levels of stress related to personal or household finances

%

faced excessive stress in trying to maintain a budget

%

were stressed by unexpected expenses

Benefits of investing in Employee Financial Well-being

By committing to financial wellness, employers can bring lasting benefits to employees, and positively impact business outcomes

Benefits for Employers1

- Reduced anxiety of employees

- More productivity

- Reduced absenteeism, presenteeism

- Reduced turnover

- Increased employee satisfaction

- Improved loyalty

- Improved morale

- Healthier employees

Benefits for Employees

- Better understanding of issues regarding personal finances

- Better support for identified needs

- Improved overall health, including mental health, i.e., less stress, anxiety, better sleep, etc.

- Satisfaction and peace of mind

- Increased participation in financial health choices resulting in greater self-confidence and life skills

- Lasting benefits intellectually, physically, socially and economically

1 Mercer Canada, Zen and the Art of Employee Financial Wellness; Sun Life Financial/Ivey, Canadian Wellness ROUI Study Update

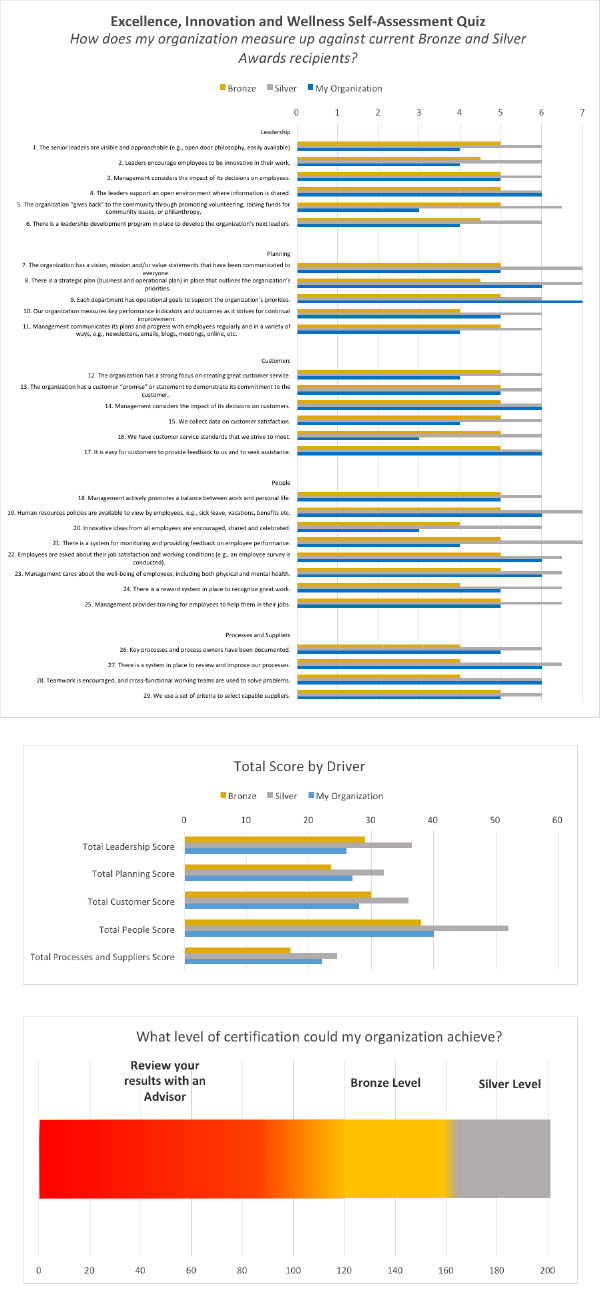

Apply for Certification

Independent validation and national recognition through the Canada Awards for Excellence,

the country’s most coveted organizational awards program.

Financial Wellness certification involves a submission describing how your organization meets the Standard’s Requirements, as well as an anonymous Excellence Canada survey completed by employees (or equivalent). The intention of this brief survey is to ensure broader participation to support the verification process. Following the submission review, a high level report will be provided. Successful applicants will be eligible for a Certificate of Merit under the Canada Awards for Excellence program.

Canada Awards for Excellence Recipient

Financial Consumer Agency of Canada

What Our Clients are Saying…

How we help

Certification

Partnership

Ready to Take Your Organization to the Next Level?

Contact Us

Request a Proposal

Fill out the request form and an Excellence Canada Certified Coach will be in touch shortly.