Dr. Adam Stoehr, Vice President, Education and Research,

Excellence Canada, Toronto, Canada

Published January 13, 2023

Abstract

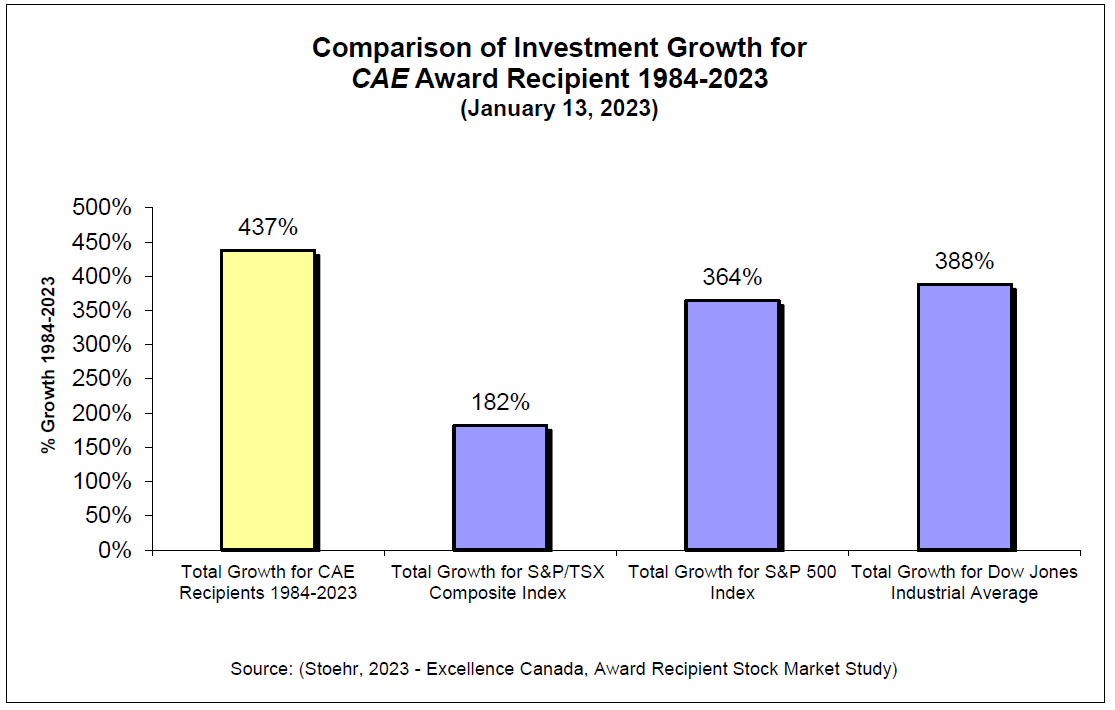

Excellence Canada tracks the stock performance for all of the Canada Awards for Excellence (CAE) recipients who are traded on a stock market. Once again in 2023, if you look at the collective return for all of the recipients between 1984 and 2022, the CAE recipients have come out on top again. Including the 2022 recipients, the organizations that have won CAE Awards outperform popular composite indices by as much as 1.90:1 with an investment growth of 437%.

Keywords: Excellence, Stock Market, Stock Performance, Link between Stock price and strategic excellence

Stock market performance is impacted by economic factors, such as consumer spending, inflation, and GDP. For example when consumer spending declines for some reason like when gasoline prices rise or a global pandemic, it leads to a slowing economy. When economies are slow, companies tend to cut back on expenses, this sometimes means layoffs, higher unemployment and even less consumer spending. This creates a vicious cycle which leads to lower company profits, lower levels of investment in the market, which causes stock prices to fall.

The heights and lows of the stock market are generally cyclical yet unpredictable. However, over the longer term there tends to be general growth on all major stock market indices. At Excellence Canada, we have always been interested in knowing if a focus on Excellence helps out with making the unpredictable nature of the stock market a little more predictable.

To see if there is any link between a commitment to Excellence and stock price, Excellence Canada tracks the stock performance for all of the Canada Awards for Excellence (CAE) recipients who are traded on a stock market. Once again in 2023, if you look at the collective return for all of the recipients between 1984 and 2022, the CAE recipients have come out on top again. Including the 2022 recipients, the organizations that have won CAE Awards outperform popular composite indices by as much as 1.90:1.

For the purposes of this research, starting with the 1984 CAE Award recipients that are traded on a stock exchange, the researcher bought an imaginary $1,000 worth of the stock on the day the winners were announced. On that same day the researcher invested an imaginary $1,000 in three popular Stock Market Indices (TSX Composite Index, S&P 500, DJIA). Each year (from 1984-2022) the researcher uses the same investment method. The following chart shows the comparison of growth.

This comparison includes all 101 CAE Award recipients that are traded on a stock exchange between 1984 and 2023. The three biggest winners in terms of investment growth include Texas Instruments with 9223% growth (CAE Recipient 1992), John Deere with 4028% growth (CAE Recipient 1998), and IBM with 2219% growth (CAE Recipient 1984, 1993, 1990). The three biggest losers in terms of investment losses include Nortel (CAE Recipient 1990), Dana (CAE Recipient 2001), and Chrysler (CAE Recipient 1991).

In total the researcher invested an imaginary $101,000 ($1000 for each recipient) in stock of award recipient and $101,000 in a composite index. Today (January 13, 2023) the CAE stock investment would be worth $542,825 (growth of 437%) where the S&P/TSX Index investment for example would be worth $284,956 (growth of 182%).

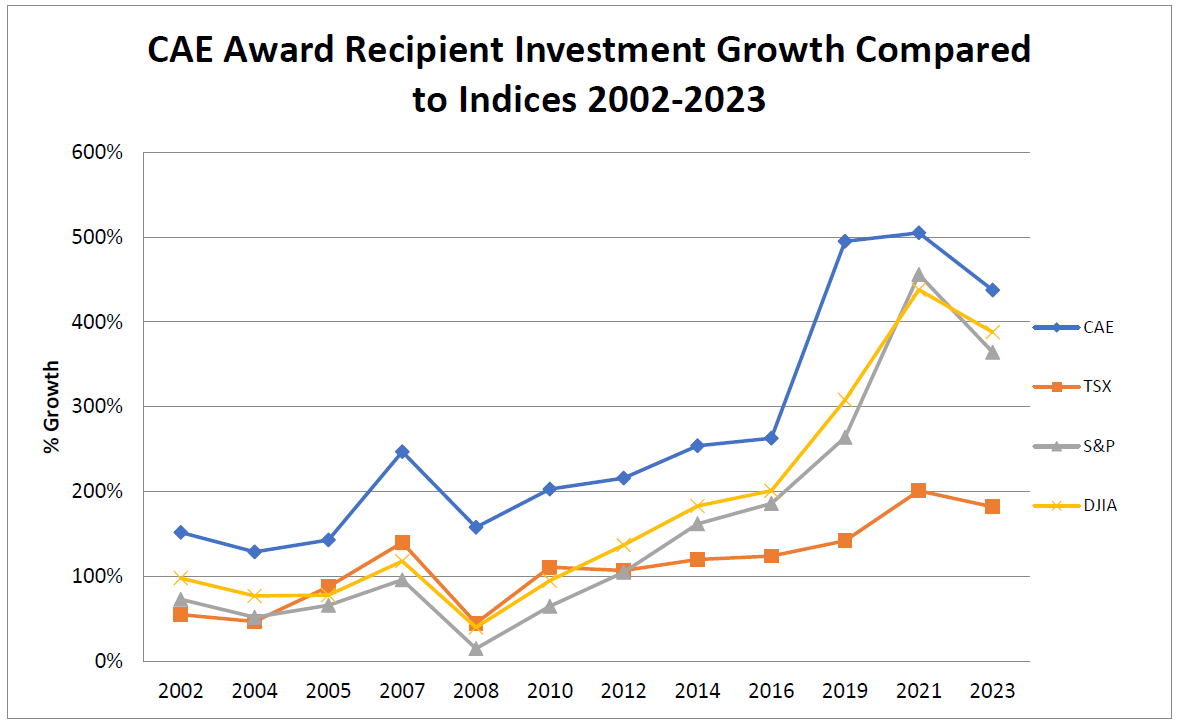

Since 2002 when this research commenced, CAE recipients have consistently outperformed the market. On the chart below the blue line represents the investment growth for the Canada Award for Excellence recipients and the other lines represent the investment growth of the indices. The peaks in 2007, 2016, 2019, and 2021 are higher than the peaks of the indices. The valleys in 2004, 2008, and 2023 are not as low for the CAE index. A commitment to Excellence makes the unpredictable market a little more predictable with higher levels of growth in every single year the research has been conducted.

Overall this research shows that organizations with a commitment to Excellence collectively have better stock market performance than any of the popular indices. The value of the investment in CAE recipients in 2023 is 1.90 times greater than the value of the investment in the S&P/TSX composite index.

About Excellence Canada

Excellence Canada is an independent, not-for-profit corporation that is committed to advancing organizational excellence across Canada. Since 1992, Excellence Canada has helped thousands of organizations become cultures of continuous quality improvement and world-class role models, through its Excellence, Innovation

As a national authority on Quality, Healthy Workplace®, and Mental Health at Work™, Excellence Canada provides excellence frameworks, standards, and independent verification and certification to organizations of all sizes and in all sectors. It is also the custodian and adjudicator of the Canada Awards for Excellence program.

For more information, please contact us:

Excellence Canada

Russ Gahan, Vice President, Operations

Email: [email protected]

O: 416.251.7600 x 249

M: 416.888.3463